Marketmind: China sets out economic, political, military vision

Marketmind: China sets out economic, political, military vision By Reuters

Breaking News

‘;

Economy 44 minutes ago (Mar 05, 2023 05:05PM ET)

(C) Reuters. FILE PHOTO: A worker walks across a construction site in the Central Business District, ahead of the opening of the National People’s Congress (NPC) in Beijing, China, February 28, 2023. REUTERS/Thomas Peter/File Photo

By Jamie McGeever

(Reuters) – A look at the day ahead in Asian markets from Jamie McGeever.

Asian markets will likely open on the front foot on Monday, following Wall Street’s whoosh higher on Friday, but a raft of Chinese economic data and remarks from U.S. Fed Chair Jerome Powell later in the week could quickly shift sentiment.

Monetary policy decisions from Australia and Japan on Wednesday and Friday, respectively, will be market-moving events too. Before that however, investors have a deluge of headlines from China this weekend to digest.

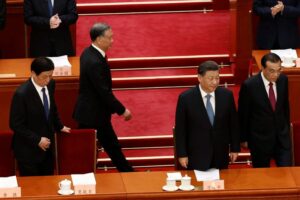

The annual session of the National People’s Congress, and reports from the finance ministry and state planner – the National Development and Reform Commission – have outlined Beijing’s broad goals and plans for the year ahead.

On the economy, the government said it would aim for growth this year of around 5%, lower than last year’s target of 5.5%. It will also take steps to minimize risks in the property sector, intensify its push to make China self-reliant in tech, and the central bank will provide ‘forceful’ support for economic development.

Perhaps most significantly, Beijing said it would boost defence spending by 7.2% – up on last year’s rate of increase and outpacing expected GDP growth – as Premier Li Keqiang called for the armed forces to boost combat preparedness.

(Graphic: MSCI Asia ex-Japan – weekly change – https://fingfx.thomsonreuters.com/gfx/mkt/zjvqjydnwpx/ChinaCPI.png)

Beijing’s macro, military and geopolitical vision for the next 12 months outlined this weekend comes as investors get more of an insight into how China’s economic reopening is progressing with the release of February trade, inflation, and credit and lending data this week.

Inflation figures from South Korea, The Philippines, Thailand and Taiwan this week will be closely watched by investors and policymakers alike. With the Fed seemingly on track to tighten policy further, a renewed rise in the dollar could intensify FX-fueled inflationary pressures in Asia.

Attention will turn to Japan later in the week, with the release of fourth-quarter GDP data on Thursday and BOJ’s policy decision on Friday, the last under the governorship of Haruhiko Kuroda.

(Graphic: MSCI Asia ex-Japan – weekly change – https://fingfx.thomsonreuters.com/gfx/mkt/klvygnjqgvg/MSCIASIA.png)

Asian stocks have generally underperformed their U.S. and global peers in recent weeks, but the underlying question still applies: How long can markets hold up – and volatility stay so low – in the face of soaring U.S. bond yields, rate and inflation expectations?

Global bond yields are moving sharply higher too. Something might be about to give.

Here are three key developments that could provide more direction to markets on Monday:

– China’s National People’s Congress

– South Korea inflation (February)

– Euro Zone retail sales (January)

(By Jamie McGeever; Editing by Diane Craft)

Marketmind: China sets out economic, political, military vision

Terms And Conditions

Privacy Policy

Risk Warning

(C) 2007-2023 Fusion Media Limited. All Rights Reserved.

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.