Exclusive-Icahn-owned oil refiner CVR bidding in Citgo share auction, sources say

By Gary McWilliams and Marianna Parraga

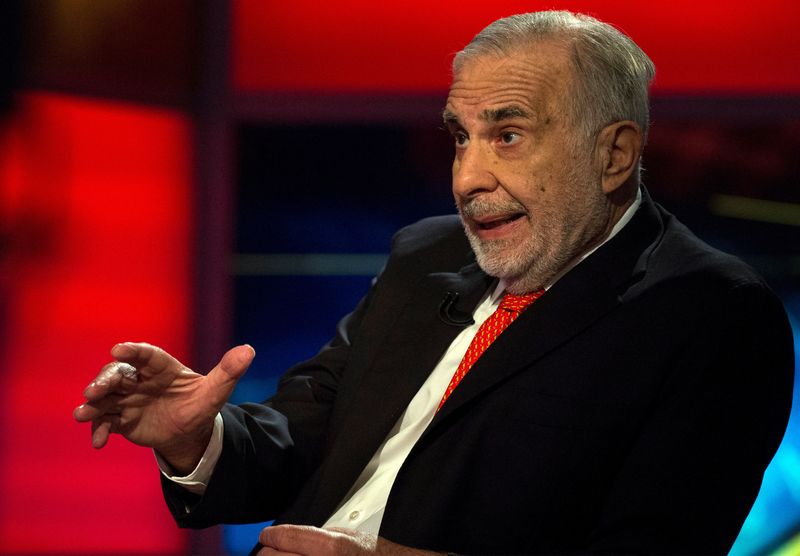

HOUSTON (Reuters) -Oil refiner CVR Energy (NYSE:CVI), controlled by billionaire investor Carl Icahn, has submitted a binding offer in an ongoing auction of shares in the parent of Venezuela-owned Citgo Petroleum, according to three people familiar with the matter.

Icahn controls about 66% of shares in CVR, based in Sugar Land, Texas. CVR operates two U.S. refineries, the 115,000 barrel-per-day (bpd) Coffeyville in Kansas, and the 75,000-bpd Wynnewood in Oklahoma.

A U.S. court in Delaware is auctioning the shares to pay creditors that have $21.3 billion in claims against Venezuela for defaults and expropriations. The court has so far accepted bids from CVR, trading house Vitol and others as part of the historic sale process of one of the parents of Citgo, the seventh largest U.S. oil refiner.

CVR is working with investment bankers at Wells Fargo to raise the financing for its bid, the people said. The company has the support of Icahn Enterprises in its offer, the people added.

Icahn Enterprises, CVR’s CEO, David Lamp, and Wells Fargo declined to comment.

CVR’s mid-continent oil refineries would make a solid geographic match to Citgo’s refineries in Texas, Louisiana and Illinois, one of the people familiar with its bid said.

“The bid advantage that CVR has is its synergies (to Citgo),” the person said. “Citgo is primarily a Gulf Coast refiner and CVI operates in the middle of the country.”

Hedge fund Elliott Investment Management was weighing another bid, while a group of creditors represented by Centerview Partners aimed to lure ConocoPhillips (NYSE:COP) to join a separate offer, people close to the matter said in April.

In recent weeks, financial allies began to build to support some of the bids, including firms JP Morgan, Morgan Stanley and Rotschild & Co.

A representative of a court officer overseeing the auction said on Tuesday in a hearing that the second bidding round was “successful,” with several competitive offers received. The bidders were not identified.

The special master of the court is scheduled to inform the parties about the winning bid around July 31. U.S. District Judge Leonard Stark, who is leading the case, on Tuesday approved a motion to postpone the final hearing to Sep. 19.