AMD stock slides as earnings, outlook meet expectations; analysts remain bullish

(Updated – May 1, 2024 4:35 AM EDT)

Advanced Micro Devices (NASDAQ:AMD) saw its shares plunge 5.5% in premarket trading Wednesday after the chipmaking giant posted in-line earnings per share (EPS) for the fiscal Q1 2024.

Specifically, the company posted EPS of $0.62, meeting analyst estimates. Revenue for the quarter reached $5.5 billion, slightly surpassing the consensus estimate of $5.48 billion.

The non-GAAP gross margin for the quarter increased by 2 percentage points year-over-year to 52%.

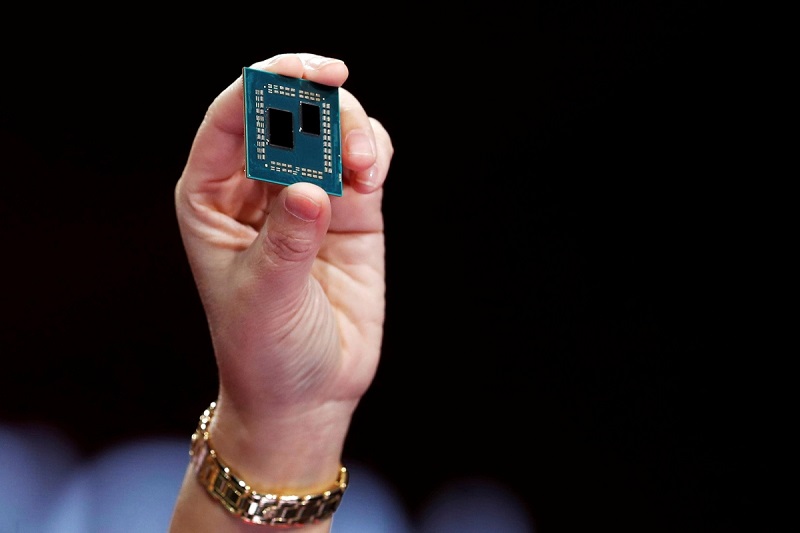

“We delivered strong first quarter results with our Data Center and Client segments each growing more than 80% year-over-year driven by the ramp of MI300 AI accelerator shipments and the adoption of our Ryzen and EPYC processors,” said AMD Chair and CEO Dr. Lisa Su.

Looking forward, AMD anticipates second-quarter 2024 revenue to range between $5.4 billion and $6 billion, compared to a consensus projection of $5.7 billion. The company estimates the midpoint of this range to reflect a year-over-year increase of about 6% and a sequential rise of roughly 4%.

AMD also expects its non-GAAP gross margin for the quarter to be about 53%.

Further, the company adjusted the 2024 revenue outlook for its Data Center GPU segment to $4 billion, from $3.5 billion. However, the revision “may have underwhelmed the most bullish of investor expectations,” analysts at Goldman Sachs said in a note.

Despite this, the Wall Street giant remains confident that AMD “is making the appropriate investments and has the long-term product roadmap in place to benefit from growth in AI infrastructure spending we envision over the medium- to long-term,” analysts continued.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Goldman Sachs reiterated a Buy rating on the stock while trimming the 12-month target price from $180 to $175.

Meanwhile, analysts at Stifel shared similarly bullish views, highlighting that AMD has reported expanded production deployments of its MI300 platforms by several key customers, including Microsoft, Meta, and Oracle.

“We believe that this dynamic bodes well for ongoing traction for AMD as its AI compute roadmap progresses. Importantly, AMD noted that customer feedback is informing roadmap decisions for both AI hardware and software,” Stifel noted.