AMD falls 7% on soft revenue forecast; Wells Fargo sees a buying opportunity

AMD falls 7% on soft revenue forecast; Wells Fargo sees a buying opportunity By Investing.com

Breaking News

‘;

AuthorSenad KaraahmetovicStock Markets

Published Jan 30, 2024 04:22PM ET

Updated Jan 31, 2024 05:34AM ET

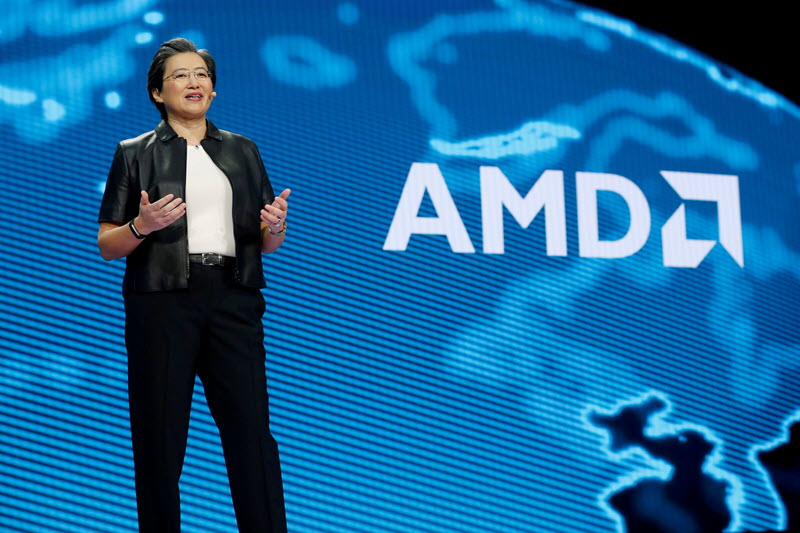

© REUTERS AMD offers better-than-expected sales guidance on ‘accelerating’ demand for high-end chips

(Updated – January 31, 2024 5:32 AM EST)

Advanced Micro Devices, Inc. (NASDAQ:AMD) reported better-than-expected financial results for its fourth quarter.

The chipmaker posted an earnings per share (EPS) of $0.77, exactly matching the analyst estimates. In terms of revenue, AMD reported a strong quarter with $6.2 billion in revenue, surpassing the consensus estimate of $6.13 billion.

The stock was down 6.6% in pre-market Wednesday trade.

Looking ahead, AMD expects its revenue to be between $5.1 billion and $5.7 billion. This forecast fell below the consensus estimate of $5.73 billion.

“We finished 2023 strong, with sequential and year-over-year revenue and earnings growth driven by record quarterly AMD Instinct GPU and EPYC CPU sales and higher AMD Ryzen processor sales,” said AMD Chair and CEO Dr. Lisa Su.

“Demand for our high-performance data center product portfolio continues to accelerate, positioning us well to deliver strong annual growth in what is an incredibly exciting time as AI re-shapes virtually every part of the computing market.”

Data Center segment revenue was $2.3 billion, up 38% year-over-year and 43% sequentially “driven by strong growth in AMD Instinct GPUs and 4th Gen AMD EPYC CPUs.”

Analysts at Wells Fargo lifted the price target by $25 to $190 per share and urged clients to buy the stock on weakness.

“Remain positive on AMD’s 2024-2025+ MI300X ramp (now model 2025 at $7.1B vs. prior $3.3B) + positioning for trad’l server CPU recovery,” the analysts commented in a post-earnings note.

Similarly, analysts at Roth MKM also lifted the price target to $190 as the company’s Data Ceter GPU guidance reflects demand.

“We believe AMD’s core data center momentum can continue to drive strength in shares with the company raising its CY24 AMD GPU guidance significantly, reflecting accelerating customer adoption.”

AMD falls 7% on soft revenue forecast; Wells Fargo sees a buying opportunity

Terms And Conditions

Privacy Policy

Risk Warning

Do not sell my personal information

© 2007-2024 Fusion Media Limited. All Rights Reserved.

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.